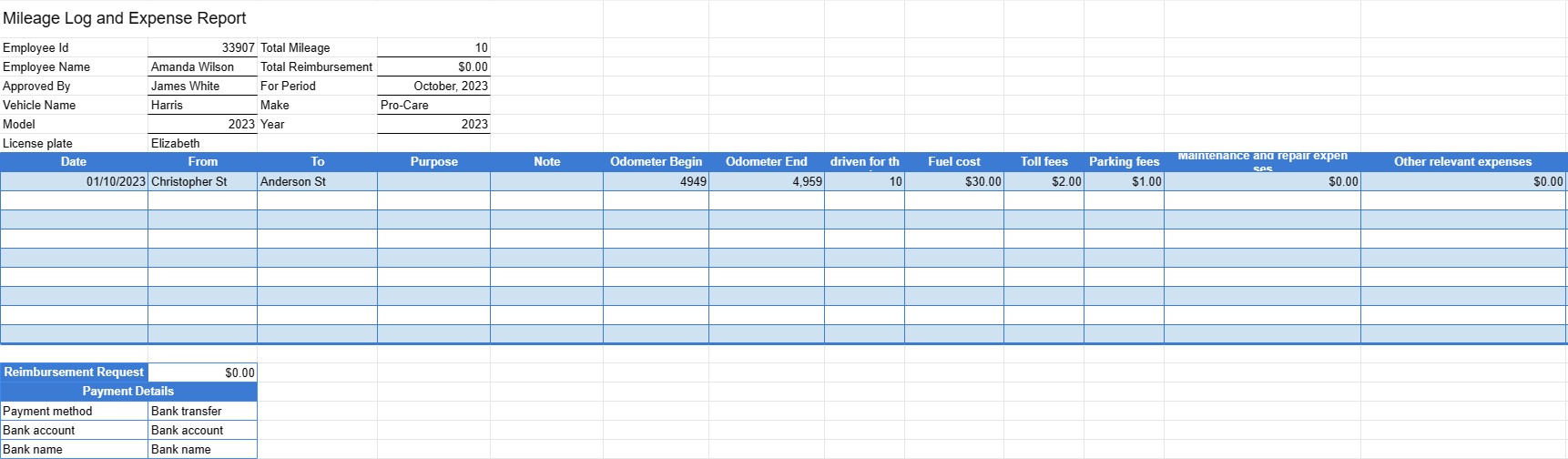

Mileage Log and Expense Report

類別 : 追蹤器

Organize the cost of operating a vehicle using this logger template.

今天是 2025年2月22日 和 你的限制是:

如果您的使用和下載用完,請使用下面的按鈕選擇最適合您自己的方案。

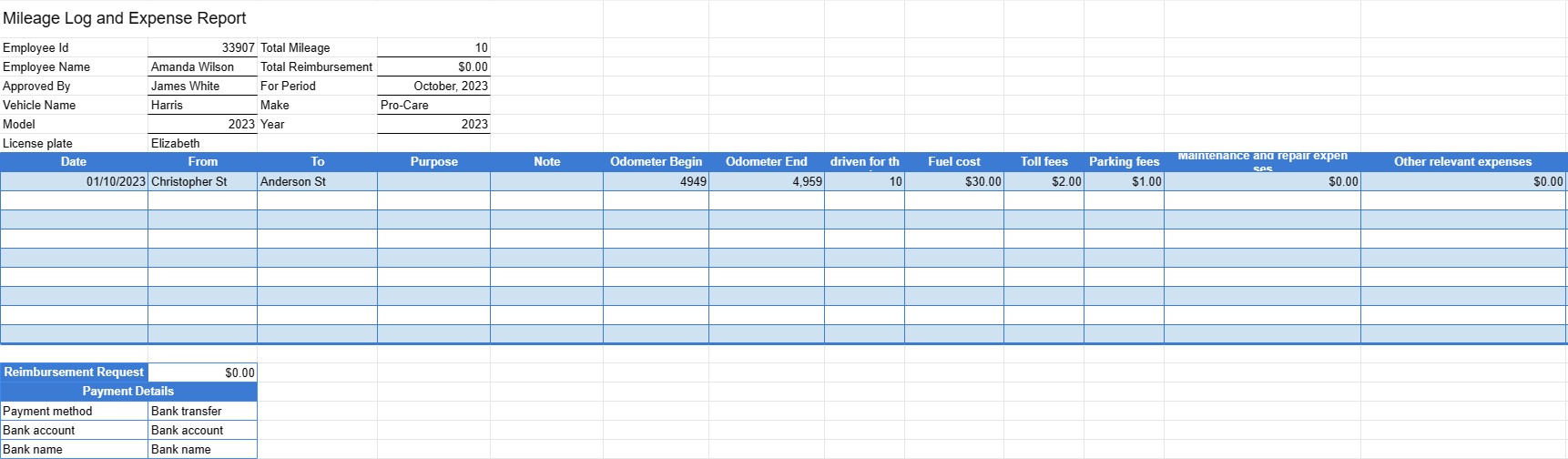

A Mileage Log and Expense Report Template is a document used by individuals, businesses, or employees who need to track and report their mileage for business purposes, such as reimbursement for travel expenses or tax deductions. It helps record details about trips, including mileage, expenses incurred during travel, and other relevant information.

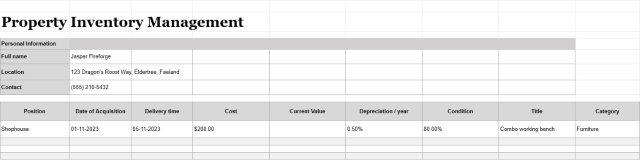

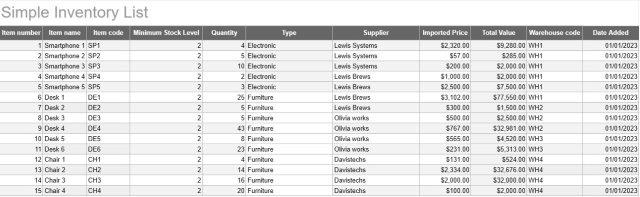

Key Components of a Mileage Log and Expense Report Template:

- Report Title: The title typically includes the purpose of the report, such as Mileage Log and Expense Report.

- Date Range: Specifies the date range for which the mileage and expenses are being reported, usually for a particular period, month, or year.

- Driver Information: Includes details about the driver, such as their name, employee ID (if applicable), and contact information.

- Vehicle Information: Specifies information about the vehicle used for the trips, including the make, model, year, and license plate number.

- Trip Log: This section records each individual trip and includes the following details:

- Date of the trip

- Starting location (e.g., address)

- Ending location (e.g., address)

- Purpose of the trip (e.g., client meeting, delivery)

- Odometer reading at the start and end of the trip

- Total miles driven for the trip

- Mileage rate used for reimbursement or tax purposes (e.g., IRS standard rate)

- Expense Log:Tracks expenses incurred during each trip, including:

- Fuel costs

- Toll fees

- Parking fees

- Maintenance and repair expenses

- Other relevant expenses

- Total Mileage:Calculates the total mileage driven during the reporting period by summing up the miles from all recorded trips.

- Total Expenses: Calculates the total expenses incurred during the reporting period by summing up all the expenses from recorded trips.

- Reimbursement Request: If the report is used for reimbursement purposes, this section specifies the total amount to be reimbursed based on the mileage and expenses.

- Payment Details: Provides information on where and how the reimbursement should be made, such as payment method and bank details.

- Signature Area: Includes a space for the driver's signature to certify the accuracy of the reported mileage and expenses.

- Supervisor or Approver Signature: In some cases, there may be a space for a supervisor or manager to approve and sign off on the report.

Benefits of Using a Mileage Log and Expense Report Template:

- Accurate Record Keeping: Ensures accurate tracking of mileage and expenses related to business travel, which is essential for reimbursement and tax purposes.

- Cost Management: Helps individuals and businesses monitor and manage travel-related expenses more effectively.

- Tax Deductions: Provides documentation for claiming tax deductions related to business mileage and expenses.

- Compliance: Helps ensure compliance with company policies and IRS regulations for mileage and expense reporting.

- Reimbursement: Simplifies the process of requesting reimbursement for business-related expenses incurred during travel.

- Transparency: Offers transparency and accountability in tracking and reporting business-related travel expenses.

- Documentation: Maintains a comprehensive record of all business-related trips, mileage, and expenses for future reference and auditing.

In conclusion, a Mileage Log and Expense Report Template is a valuable tool for individuals and businesses that need to track and report business-related mileage and expenses accurately. It helps streamline the reimbursement process, ensures compliance with tax regulations, and provides a transparent record of travel-related financial transactions.