Monthly Cash Flow

Category : Trackers

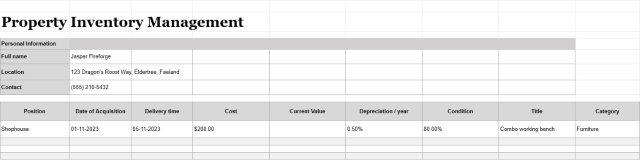

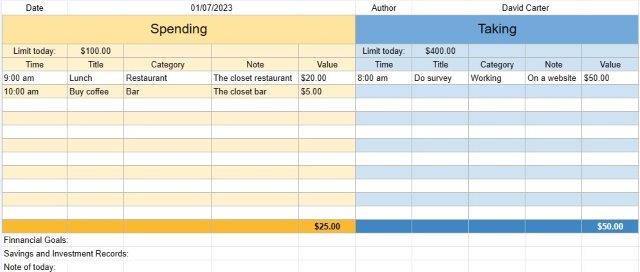

Accountant whom are working in organization usually use this to solve the problem with the expense and income of the firms.

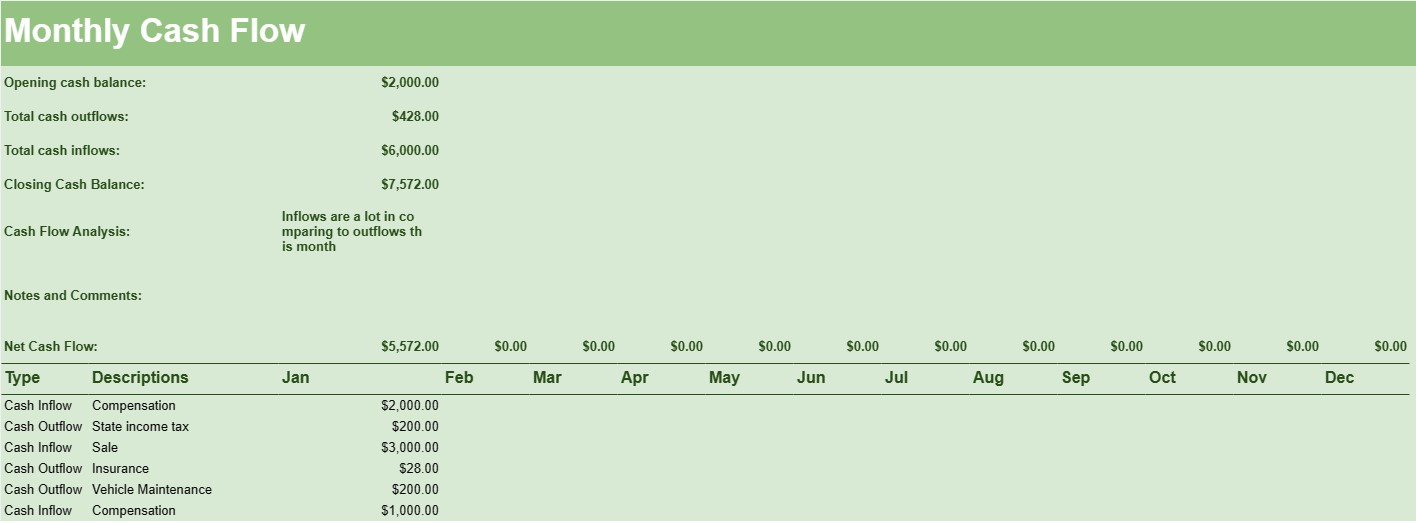

The Monthly Cash Flow template is a financial management tool that provides a detailed snapshot of a company's or individual's cash inflows and outflows over a specific month. It is a critical document for monitoring and managing financial liquidity, ensuring that there is enough cash on hand to cover expenses and make strategic financial decisions.

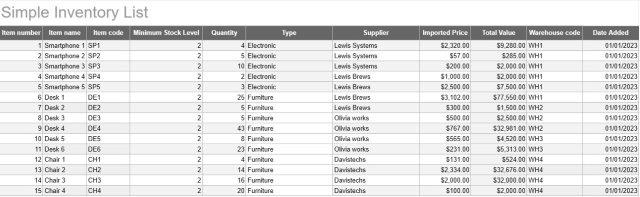

Here are the key components typically included in a Monthly Cash Flow template:

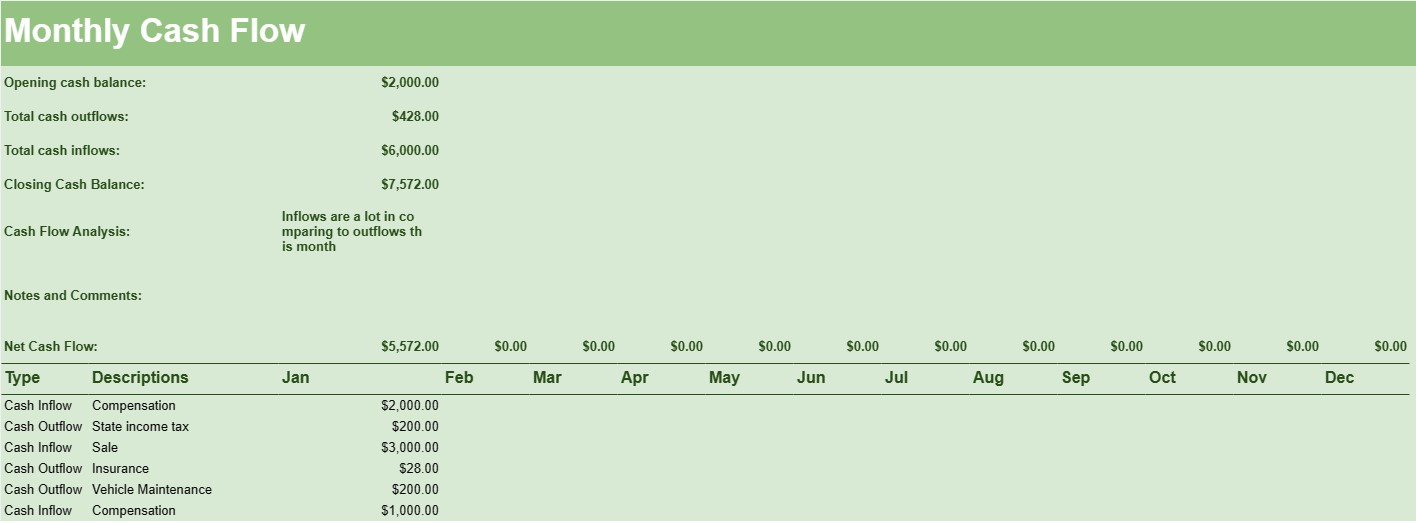

- Opening Cash Balance: This is the amount of cash on hand at the beginning of the month, often carried over from the previous month's closing balance.

- Cash Inflows: This section details all sources of cash inflow during the month. Common examples include revenue from sales, investments, loans, and other income sources. Each source is listed separately with the corresponding amounts.

- Cash Outflows: Here, all cash expenses for the month are outlined. These can include rent or mortgage payments, utilities, payroll, inventory purchases, loan repayments, and any other expenses that require cash payments.

- Net Cash Flow: The net cash flow is calculated by subtracting the total cash outflows from the total cash inflows. It provides a clear picture of whether the entity had a surplus or deficit of cash during the month.

- Closing Cash Balance: The closing cash balance is calculated by adding the net cash flow to the opening cash balance. It represents the amount of cash on hand at the end of the month.

- Cash Flow Analysis: Some Monthly Cash Flow templates include a section for analyzing cash flow trends and identifying areas where improvements can be made. This can help in optimizing financial management strategies.

- Notes and Comments: There may be space for notes or comments where users can provide explanations or context regarding specific cash flow events or anomalies.

The Monthly Cash Flow template is an essential financial planning and monitoring tool for businesses and individuals. It helps them maintain a clear understanding of their cash position, enabling them to make informed decisions regarding spending, saving, and investments. By regularly reviewing cash flow statements, organizations can ensure they have the liquidity needed to cover expenses, take advantage of opportunities, and weather financial challenges.

For businesses, managing cash flow effectively is vital for ongoing operations, growth, and financial stability. It helps prevent cash shortages that could lead to missed payments, financial strain, or even insolvency. Individuals can also benefit from a Monthly Cash Flow template by tracking their income and expenses, setting savings goals, and managing their personal finances more effectively.

In summary, the Monthly Cash Flow template serves as a critical financial management tool, offering a clear and comprehensive view of cash movements during a specific month. It empowers users to maintain control over their financial resources and make informed financial decisions to achieve their goals.

Easy Preview and Download Spreadsheet Template

View the full version of a spreadsheet template with no limitations to see if you like it then you can download the excel template to store it on your device and use it for free.

Access Spreadsheet Template from Anywhere

This is working on all popular operating system such as Windows, MacOS, Linux, iOS. You can see the spreadsheet templates and download them without additional programs.

How to use a template

Figure out how to preview, download and then use the spreadsheet template by following the steps which are extremely easy to follow

More similar templates

See more of the spreadsheet templates which are under the same category with the chosen one.