Μηνιαίος προσωπικός προϋπολογισμός

Κατηγορία : Προϋπολογισμοί

Οργανώστε τις προσωπικές μηνιαίες δαπάνες και το εισόδημά σας χρησιμοποιώντας αυτό το πρότυπο

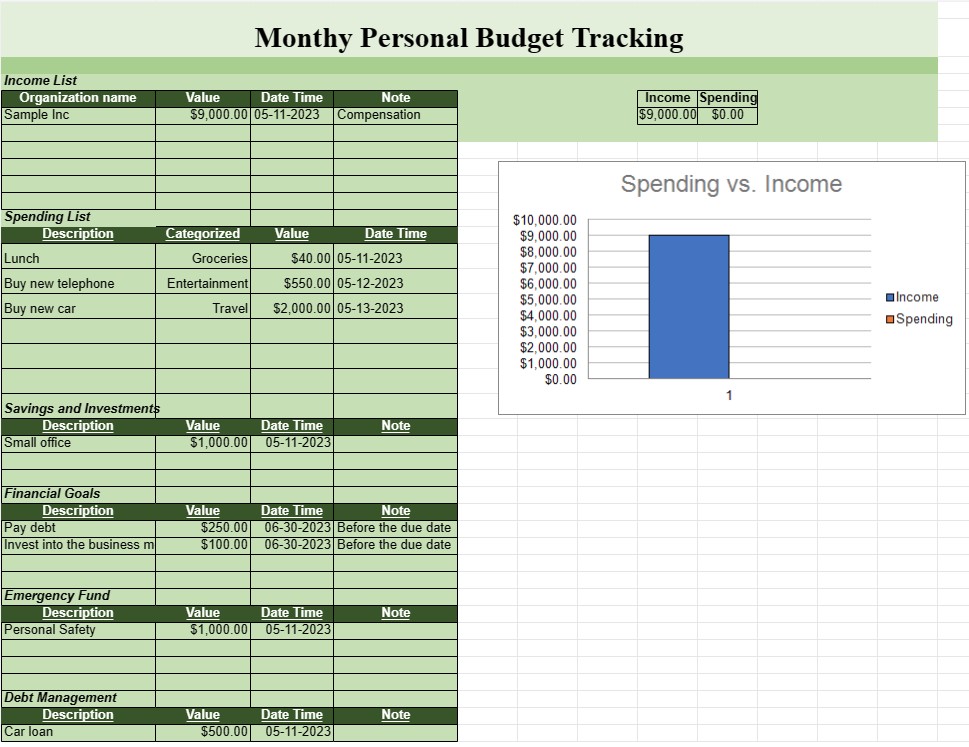

Ένα έγγραφο προτύπου Προσωπικού Προϋπολογισμού είναι ένα ολοκληρωμένο εργαλείο που χρησιμοποιείται από άτομα ή νοικοκυριά για την αποτελεσματική διαχείριση των οικονομικών τους. Είναι ένα δομημένο πλαίσιο που επιτρέπει στα άτομα να παρακολουθούν και να ελέγχουν τα έσοδα, τα έξοδα, τις αποταμιεύσεις και τις επενδύσεις τους σε τακτική βάση.

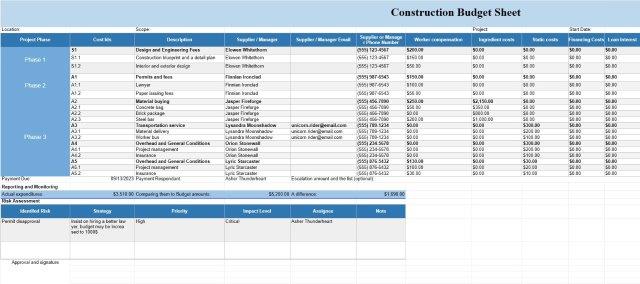

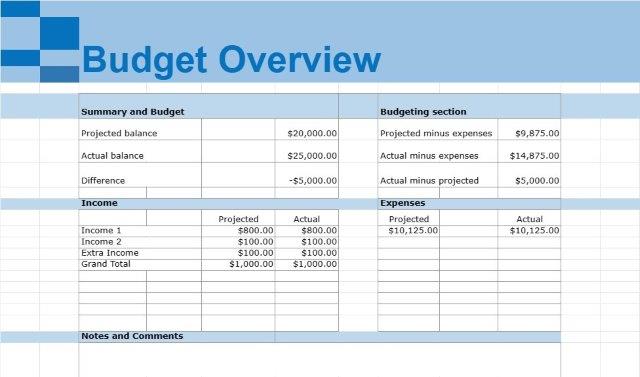

Τα βασικά στοιχεία ενός εγγράφου προτύπου Προσωπικού Προϋπολογισμού περιλαμβάνουν:

- Παρακολούθηση εισοδήματος: Οι χρήστες μπορούν να καταγράφουν όλες τις πηγές εισοδήματος, όπως μισθούς, μισθούς, εισόδημα από ενοίκια, τόκους και μερίσματα. Αυτή η ενότητα παρέχει μια σαφή επισκόπηση των συνολικών εσόδων που είναι διαθέσιμα για την κατάρτιση προϋπολογισμού.

- Κατηγοριοποίηση δαπανών: Τα έξοδα κατηγοριοποιούνται σε σταθερές και μεταβλητές κατηγορίες. Στα σταθερά έξοδα περιλαμβάνονται στοιχεία όπως πληρωμές υποθηκών ή ενοικίων, υπηρεσίες κοινής ωφέλειας, ασφάλιστρα και αποπληρωμή δανείων. Τα μεταβλητά έξοδα περιλαμβάνουν διακριτικές δαπάνες όπως παντοπωλεία, φαγητό, ψυχαγωγία και ταξίδια.

- Προϋπολογισμός: Το πρότυπο διευκολύνει τη δημιουργία προϋπολογισμού επιτρέποντας στους χρήστες να διαθέσουν συγκεκριμένα ποσά σε κάθε δαπάνη. κατηγορία. Αυτό βοηθά στον καθορισμό ορίων δαπανών και στη διασφάλιση ότι το εισόδημα καλύπτει όλα τα απαραίτητα έξοδα.

- Εξοικονομήσεις και επενδύσεις: Ένα έγγραφο προτύπου Προσωπικού Προϋπολογισμού περιλαμβάνει συχνά ενότητες για τον καθορισμό στόχων εξοικονόμησης και την παρακολούθηση της προόδου. Οι χρήστες μπορούν να διαθέσουν κεφάλαια για αποταμιεύσεις έκτακτης ανάγκης, λογαριασμούς συνταξιοδότησης, επενδυτικά χαρτοφυλάκια ή άλλους οικονομικούς στόχους.

- Ανάλυση και αναφορά: Οι χρήστες μπορούν να ενημερώνουν τακτικά το έγγραφο για να καταγράφουν τα πραγματικά έσοδα και έξοδα. Συγκρίνοντας τα πραγματικά με τον προϋπολογισμό, τα άτομα μπορούν να εντοπίσουν τομείς όπου μπορεί να ξοδεύουν υπερβολικά ή να έχουν περιθώρια για πρόσθετες οικονομίες.

- Οικονομικοί στόχοι: Το πρότυπο μπορεί επίσης να χρησιμεύσει ως πλατφόρμα ρύθμισης. και παρακολούθηση οικονομικών στόχων. Είτε πρόκειται για εξόφληση του χρέους, είτε για αποταμίευση για διακοπές ή για επενδύσεις για συνταξιοδότηση, οι χρήστες μπορούν να τεκμηριώσουν τους στόχους τους και να παρακολουθούν την πρόοδό τους.

- Ταμείο έκτακτης ανάγκης: Πολλά πρότυπα Προσωπικού Προϋπολογισμού περιλαμβάνουν ένα συγκεκριμένο συγκεκριμένο πρόγραμμα. τμήμα για ένα ταμείο έκτακτης ανάγκης. Αυτό ενθαρρύνει τα άτομα να δώσουν προτεραιότητα στην εξοικονόμηση πόρων για απροσδόκητα έξοδα ή οικονομικές καταστάσεις έκτακτης ανάγκης.

- Διαχείριση χρέους: Για όσους ασχολούνται με χρέη, το πρότυπο μπορεί να βοηθήσει στη διαχείριση και παρακολούθηση των σχεδίων αποπληρωμής του χρέους. Επιτρέπει στους χρήστες να κατανέμουν κεφάλαια για την εξόφληση των χρεών συστηματικά.

- Οικονομική ενημερότητα: Ίσως ένα από τα πιο σημαντικά οφέλη της χρήσης ενός εγγράφου προτύπου Προσωπικού Προϋπολογισμού είναι ότι ενισχύει την οικονομική ευαισθητοποίηση. Παρέχει μια λεπτομερή εικόνα της οικονομικής κατάστασης κάποιου, βοηθώντας τα άτομα να λαμβάνουν ενημερωμένες αποφάσεις σχετικά με τις δαπάνες, την αποταμίευση και την επένδυση.

Ουσιαστικά, ένα έγγραφο προτύπου Προσωπικού Προϋπολογισμού είναι ένα ευέλικτο εργαλείο που δίνει τη δυνατότητα στα άτομα να αναλάβουν τον έλεγχο των οικονομικών τους, θέτουν και επιτυγχάνουν οικονομικούς στόχους, αποφεύγουν τα περιττά χρέη και χτίζουν ένα ασφαλές οικονομικό μέλλον. Προωθεί την πειθαρχία στη διαχείριση των χρημάτων και αποτελεί ουσιαστικό πόρο για την οικονομική ευημερία.

Εύκολη προεπισκόπηση και λήψη προτύπου υπολογιστικού φύλλου

Δείτε την πλήρη έκδοση ενός προτύπου υπολογιστικού φύλλου χωρίς περιορισμούς για να δείτε αν σας αρέσει, στη συνέχεια, μπορείτε να κάνετε λήψη του προτύπου excel για να το αποθηκεύσετε στη συσκευή σας και να το χρησιμοποιήσετε δωρεάν.

Πρόσβαση στο πρότυπο υπολογιστικού φύλλου από οπουδήποτε

Αυτό λειτουργεί σε όλα τα δημοφιλή λειτουργικά συστήματα όπως Windows, MacOS, Linux, iOS. Μπορείτε να δείτε τα πρότυπα υπολογιστικών φύλλων και να τα κατεβάσετε χωρίς πρόσθετα προγράμματα.

Πώς να χρησιμοποιήσετε ένα πρότυπο

Μάθετε πώς να κάνετε προεπισκόπηση, λήψη και, στη συνέχεια, χρήση του προτύπου υπολογιστικού φύλλου ακολουθώντας τα βήματα που είναι εξαιρετικά εύκολο να ακολουθήσετε

Περισσότερα παρόμοια πρότυπα

Δείτε περισσότερα από τα πρότυπα υπολογιστικών φύλλων που ανήκουν στην ίδια κατηγορία με το επιλεγμένο.